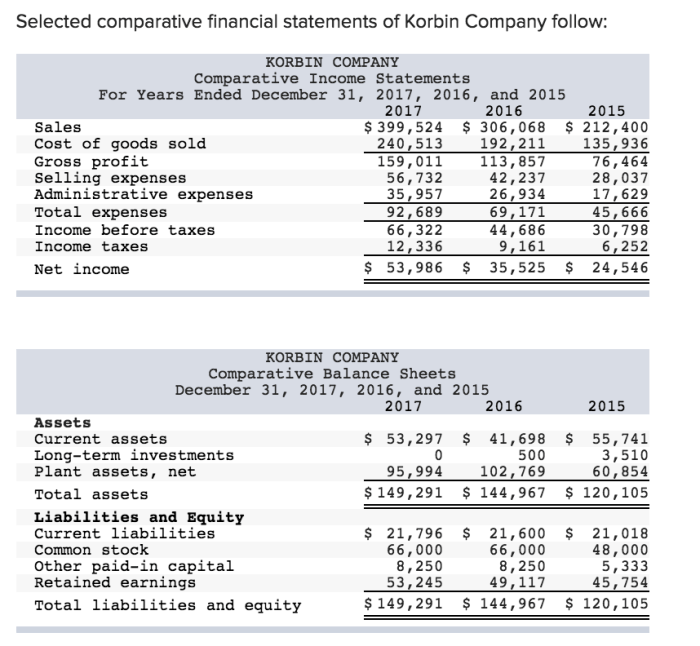

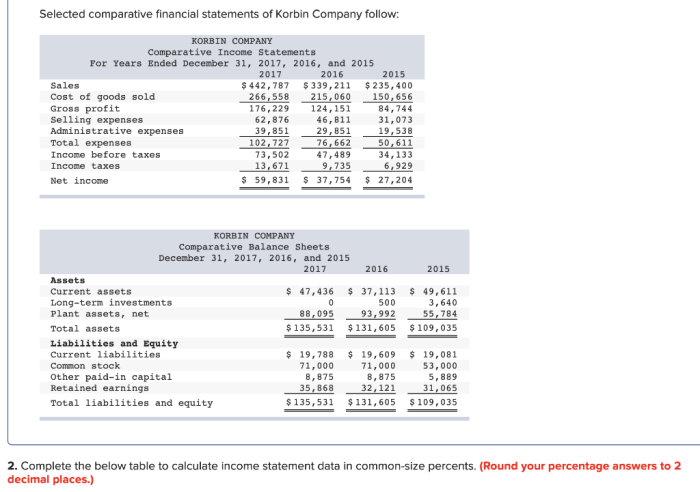

Selected comparative financial statements of korbin company follow – Comparative financial statements of Korbin Company provide a comprehensive overview of the company’s financial performance over time. This analysis allows stakeholders to assess the company’s financial health, identify trends, and make informed decisions.

By comparing financial statements from different periods, analysts can gain insights into the company’s revenue growth, profitability, and financial leverage. This information is crucial for evaluating the company’s financial performance, making investment decisions, and assessing the company’s overall financial health.

Comparative Financial Statement Analysis

Comparative financial statements are a powerful tool for assessing a company’s financial performance over time. They allow analysts to identify trends, patterns, and relationships that may not be evident from a single period’s financial statements.

The purpose of comparative financial statements is to provide a basis for evaluating a company’s financial condition and performance over multiple periods. By comparing financial statements from different periods, analysts can identify changes in the company’s financial position, profitability, and cash flows.

There are several benefits to analyzing comparative financial statements. First, they can help analysts identify trends and patterns in a company’s financial performance. This information can be used to make informed decisions about the company’s future prospects.

Second, comparative financial statements can help analysts identify areas of strength and weakness in a company’s financial performance. This information can be used to develop strategies to improve the company’s financial position.

Third, comparative financial statements can help analysts assess the effectiveness of a company’s management team. By comparing the company’s financial performance to that of its competitors, analysts can determine whether the company’s management team is making sound decisions.

Key Financial Ratios

There are a number of key financial ratios that are used in comparative financial statement analysis. These ratios can be used to assess a company’s liquidity, profitability, and solvency.

- Current ratio: The current ratio measures a company’s ability to meet its short-term obligations. It is calculated by dividing the company’s current assets by its current liabilities.

- Quick ratio: The quick ratio is a more conservative measure of a company’s liquidity than the current ratio. It is calculated by dividing the company’s current assets minus its inventory by its current liabilities.

- Debt-to-equity ratio: The debt-to-equity ratio measures the amount of debt a company has relative to its equity. It is calculated by dividing the company’s total debt by its total equity.

- Gross profit margin: The gross profit margin measures a company’s profitability. It is calculated by dividing the company’s gross profit by its net sales.

- Operating profit margin: The operating profit margin measures a company’s profitability from its core operations. It is calculated by dividing the company’s operating profit by its net sales.

- Net profit margin: The net profit margin measures a company’s profitability after all expenses have been paid. It is calculated by dividing the company’s net income by its net sales.

Horizontal Analysis

Horizontal analysis is a technique that is used to compare financial statements over time. This technique involves calculating the percentage change in each line item on the financial statements from one period to the next.

Horizontal analysis can be used to identify trends and patterns in a company’s financial performance. This information can be used to make informed decisions about the company’s future prospects.

Vertical Analysis, Selected comparative financial statements of korbin company follow

Vertical analysis is a technique that is used to compare the different line items on a financial statement to each other. This technique involves calculating the percentage of each line item to the total.

Vertical analysis can be used to identify the relative importance of different line items on a financial statement. This information can be used to make informed decisions about the company’s financial position.

Trend Analysis

Trend analysis is a technique that is used to identify trends and patterns in financial data over time. This technique involves plotting financial data over time and looking for patterns.

Trend analysis can be used to identify opportunities and threats for a company. This information can be used to make informed decisions about the company’s future prospects.

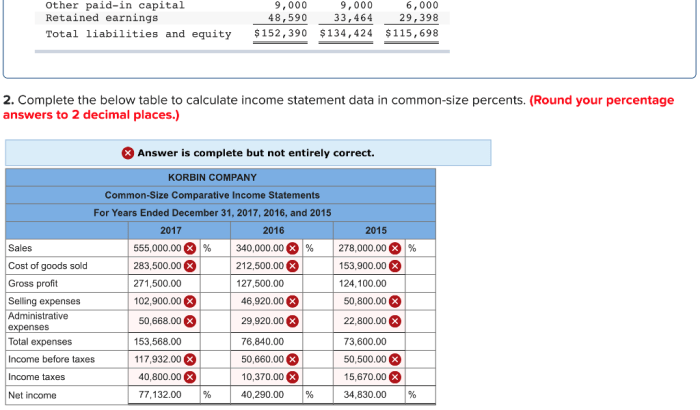

Common-Size Analysis

Common-size analysis is a technique that is used to convert financial statements to a common base for comparison. This technique involves dividing each line item on the financial statements by a common denominator, such as total assets or net sales.

Common-size analysis can be used to compare the financial performance of different companies, even if they are of different sizes. This information can be used to make informed decisions about the relative attractiveness of different investment opportunities.

Limitations of Comparative Financial Statement Analysis

There are a number of limitations to comparative financial statement analysis. These limitations include:

- The data on financial statements may not be reliable or accurate.

- The data on financial statements may not be comparable from one period to the next.

- The data on financial statements may not be relevant to the user’s needs.

It is important to be aware of these limitations when using comparative financial statement analysis. By understanding the limitations of this technique, users can avoid making incorrect or misleading conclusions.

Example Analysis

The following is an example of a comparative financial statement analysis. The analysis compares the financial performance of two companies, Company A and Company B, over a two-year period.

| Company A | Company B | |||

|---|---|---|---|---|

| Year | 2020 | 2021 | 2020 | 2021 |

| Net sales | $100,000 | $120,000 | $120,000 | $140,000 |

| Cost of goods sold | $60,000 | $72,000 | $72,000 | $84,000 |

| Gross profit | $40,000 | $48,000 | $48,000 | $56,000 |

| Operating expenses | $20,000 | $24,000 | $24,000 | $28,000 |

| Net income | $20,000 | $24,000 | $24,000 | $28,000 |

The analysis shows that both companies experienced an increase in net sales and net income from 2020 to 2021. However, Company A’s net income grew at a faster rate than Company B’s net income.

The analysis also shows that Company A’s gross profit margin improved from 40% in 2020 to 48% in 2021. This indicates that Company A is becoming more efficient at generating profits from its sales.

General Inquiries: Selected Comparative Financial Statements Of Korbin Company Follow

What is the purpose of comparative financial statement analysis?

Comparative financial statement analysis allows stakeholders to assess a company’s financial performance over time, identify trends, and make informed decisions.

What are the benefits of analyzing comparative financial statements?

Comparative financial statement analysis provides insights into a company’s revenue growth, profitability, financial leverage, and overall financial health.

What are the limitations of comparative financial statement analysis?

Limitations include the use of historical data, the impact of accounting changes, and the potential for manipulation.