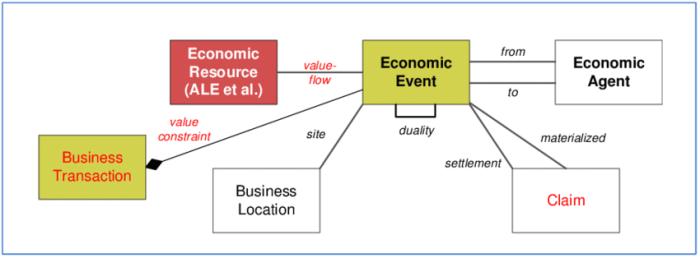

REA accounting systems and analytics offer a transformative approach to financial management, empowering businesses with real-time insights, data-driven decision-making, and seamless integration for optimized performance. This comprehensive guide delves into the intricacies of REA systems, data analytics, and their integration, providing a roadmap for organizations seeking to enhance their financial operations.

Real-Time Accounting Systems

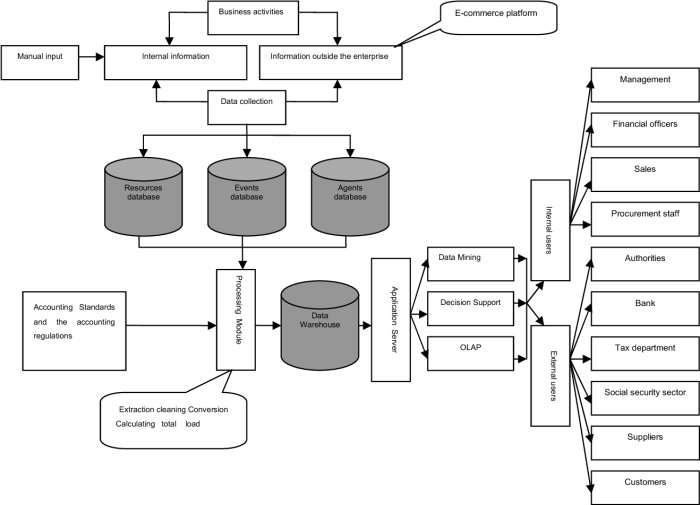

Real-time accounting systems are computerized accounting systems that provide immediate access to financial data. This allows businesses to make better decisions, improve customer service, and reduce costs.

Benefits of Real-Time Accounting Systems

- Improved decision-making: Real-time accounting systems provide businesses with up-to-date financial information, which can help them make better decisions about pricing, production, and marketing.

- Enhanced customer service: Real-time accounting systems allow businesses to track customer orders and payments in real time, which can help them provide better customer service.

- Reduced costs: Real-time accounting systems can help businesses reduce costs by automating tasks, such as invoicing and billing.

Examples of Real-Time Accounting Systems

- QuickBooks Online

- Xero

- NetSuite

Challenges of Implementing Real-Time Accounting Systems

- Cost: Real-time accounting systems can be expensive to implement and maintain.

- Complexity: Real-time accounting systems can be complex to implement and use.

- Data security: Real-time accounting systems can be vulnerable to data security breaches.

Data Analytics for Accounting: Rea Accounting Systems And Analytics

Data analytics plays a crucial role in modern accounting practices, enabling accountants to analyze vast amounts of data to extract meaningful insights and improve decision-making. Various types of data analytics are employed in accounting, each with its unique capabilities and applications.

Descriptive Analytics

- Provide a snapshot of historical data, summarizing key performance indicators (KPIs) and trends.

- Help accountants understand the current financial health of an organization and identify areas for improvement.

Predictive Analytics

- Use statistical models to predict future outcomes based on historical data and patterns.

- Enable accountants to forecast financial performance, assess risk, and make informed decisions about resource allocation.

Prescriptive Analytics

- Go beyond prediction by providing specific recommendations for actions that can be taken to achieve desired outcomes.

- Assist accountants in optimizing business processes, reducing costs, and maximizing revenue.

Challenges of Using Data Analytics in Accounting

- Data quality and availability:Ensuring the accuracy and completeness of data can be challenging.

- Technical skills and expertise:Accountants may need specialized training to effectively use data analytics tools and interpret results.

- Bias and interpretability:Data analytics models can introduce biases if not properly designed and validated.

Integration of Accounting Systems and Analytics

The integration of accounting systems and analytics offers a transformative opportunity to enhance financial reporting, decision-making, and overall business performance. By combining the robust data collection capabilities of accounting systems with the analytical power of data analytics tools, organizations can gain unprecedented insights into their financial operations and make data-driven decisions.

Benefits of Integrating Accounting Systems and Analytics

- Enhanced Data Accuracy and Consistency:Integration ensures seamless data flow between systems, eliminating errors and inconsistencies that arise from manual data entry and reconciliation.

- Real-Time Reporting:Analytics tools can process data from accounting systems in real-time, enabling organizations to monitor financial performance, identify trends, and make timely adjustments.

- Improved Financial Forecasting:By leveraging historical financial data and analytics, organizations can develop more accurate financial forecasts, enabling them to plan for future growth and mitigate risks.

- Fraud Detection and Prevention:Analytics can identify anomalies and suspicious patterns in financial data, helping organizations detect and prevent fraud.

- Data-Driven Decision-Making:Integrated systems provide decision-makers with access to timely and accurate financial information, empowering them to make informed decisions based on data rather than intuition.

Examples of Integration

Integration of accounting systems and analytics can be achieved through various methods, including:

- Direct Integration:This involves connecting accounting systems directly to analytics platforms, enabling real-time data transfer and analysis.

- API Integration:Application Programming Interfaces (APIs) can be used to establish a connection between accounting systems and analytics tools, allowing for data exchange and analysis.

- Cloud-Based Integration:Cloud-based accounting systems and analytics platforms can be integrated seamlessly, providing a centralized platform for data management and analysis.

Challenges of Integration

While integration offers significant benefits, it also presents challenges that organizations must address:

- Data Quality:Ensuring the accuracy and completeness of data is crucial for effective analytics. Organizations must establish robust data governance practices to maintain data integrity.

- Technical Expertise:Integrating accounting systems and analytics requires technical expertise to configure and maintain the systems effectively.

- Cost:Implementing and maintaining integrated systems can be costly, and organizations must carefully evaluate the return on investment.

- Change Management:Integrating systems can disrupt existing workflows and require organizational change management to ensure successful adoption.

- Security:Organizations must implement robust security measures to protect sensitive financial data from unauthorized access and cyber threats.

Emerging Trends in Accounting Systems and Analytics

The accounting profession is undergoing a significant transformation, driven by the rapid advancement of technology. Emerging trends in accounting systems and analytics are reshaping the way businesses manage their finances and make decisions.

Cloud-Based Accounting Systems

Cloud-based accounting systems offer several advantages over traditional on-premises systems, including increased accessibility, scalability, and cost-effectiveness. Businesses can access their financial data from anywhere with an internet connection, making it easier to collaborate with accountants and other stakeholders.

Artificial Intelligence (AI) and Machine Learning (ML)

AI and ML are being used to automate repetitive tasks, such as data entry and reconciliation. This frees up accountants to focus on more strategic tasks, such as analysis and decision-making. AI can also be used to detect fraud and anomalies in financial data.

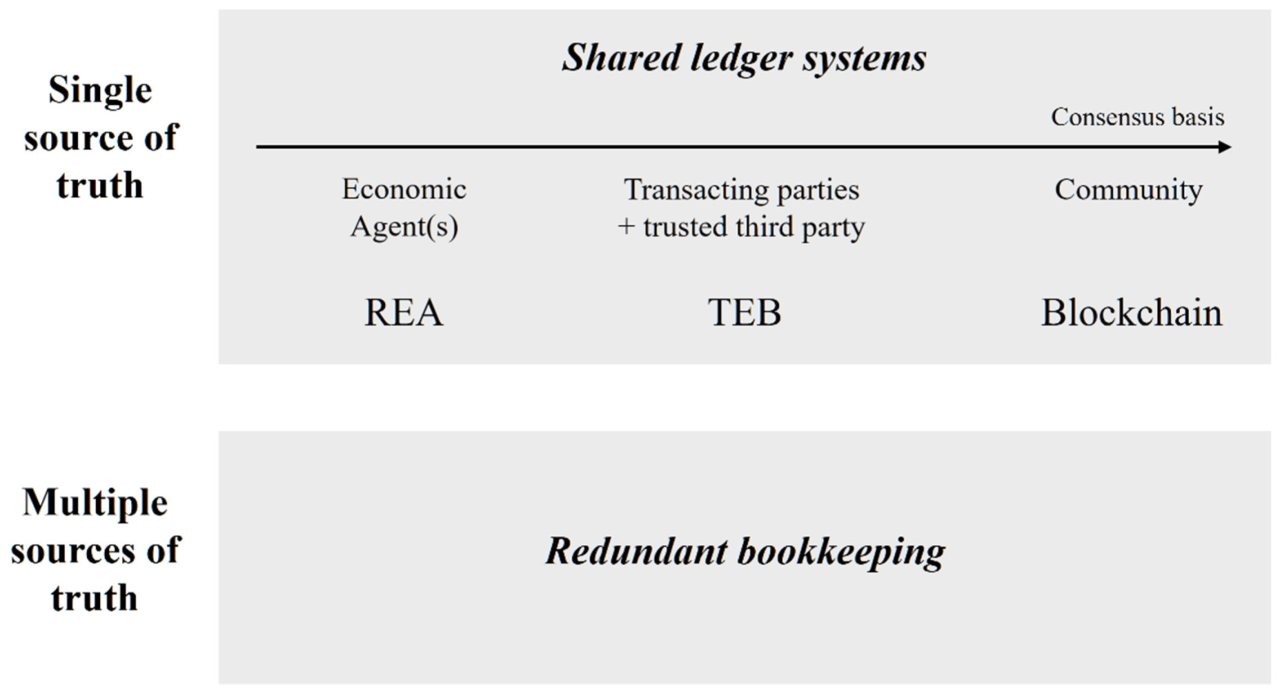

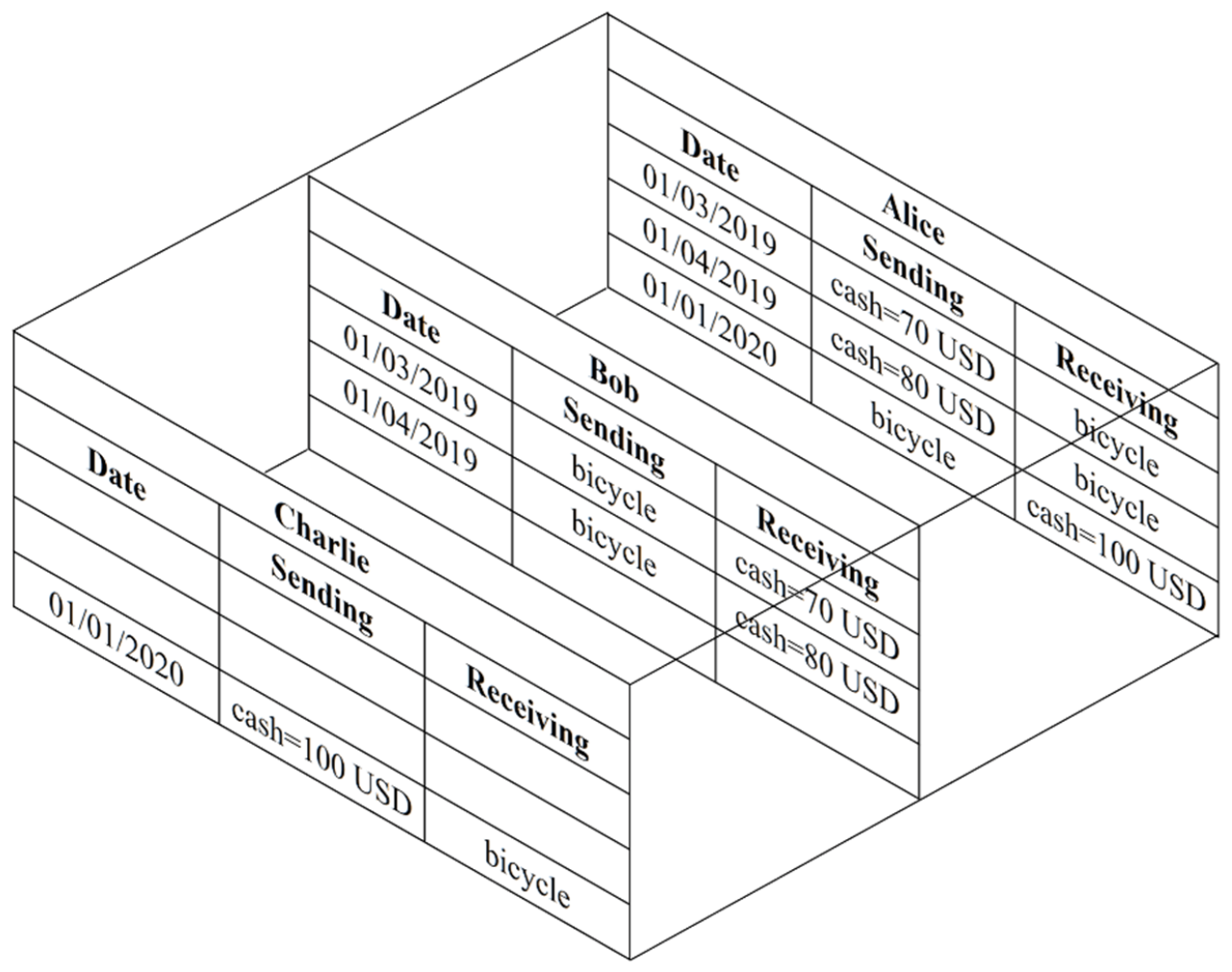

Blockchain Technology

Blockchain technology is a distributed ledger system that is secure and transparent. It has the potential to revolutionize accounting by providing a secure and efficient way to record and track financial transactions.

Data Analytics and Visualization

Data analytics and visualization tools are being used to extract insights from financial data. This information can be used to improve decision-making, identify trends, and forecast future performance.

Integration of Accounting Systems with Other Business Applications

Accounting systems are increasingly being integrated with other business applications, such as enterprise resource planning (ERP) systems and customer relationship management (CRM) systems. This integration provides a more comprehensive view of the business and enables more efficient decision-making.

Impact on the Accounting Profession, Rea accounting systems and analytics

These emerging trends are having a significant impact on the accounting profession. Accountants need to develop new skills and knowledge to stay relevant in the changing landscape. They must be able to use technology effectively and understand how it can be used to improve accounting processes.

Examples of Business Use of Emerging Trends

Many businesses are already using emerging trends in accounting systems and analytics to improve their operations. For example:

- Walmart uses AI to automate its inventory management system.

- Amazon uses blockchain technology to track its supply chain.

- Google uses data analytics to identify trends in customer behavior.

FAQ Explained

What are the key benefits of using REA accounting systems?

REA systems provide real-time visibility into financial transactions, enhance accuracy, reduce errors, streamline processes, and improve compliance.

How can data analytics improve accounting processes?

Data analytics enables the identification of trends, patterns, and anomalies, leading to better decision-making, risk management, and fraud detection.

What are the challenges associated with integrating accounting systems and analytics?

Challenges include data compatibility issues, data security concerns, and the need for skilled professionals to manage and interpret data.